Explained | who will benefit from the upi-paynow link?

Explained | who will benefit from the upi-paynow link?"

- Select a language for the TTS:

- UK English Female

- UK English Male

- US English Female

- US English Male

- Australian Female

- Australian Male

- Language selected: (auto detect) - EN

Play all audios:

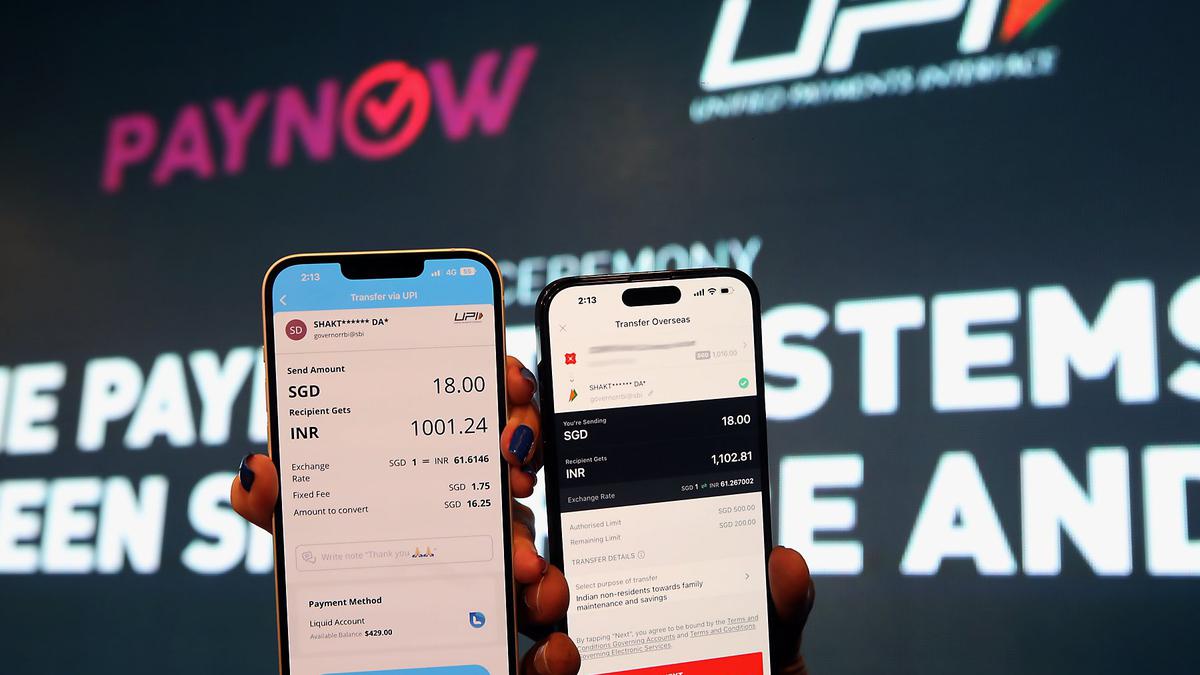

THE STORY SO FAR: On February 21, India’s Unified Payments Interface (UPI) and Singapore’s PayNow were officially connected to allow for “real-time payment linkage”. Singapore is the first

country with which cross-border Person to Person (P2P) payment facilities have been launched. The plan was first announced by the Reserve Bank of India (RBI) and the Monetary Authority of

Singapore (MAS) in September 2021 to facilitate instant low-cost, cross-border fund transfer. HOW WILL IT HELP? When the scheme was announced, the RBI had said that the cross-border

interoperability of payments using cards and QR codes between India and Singapore would further anchor trade, travel, and remittance flows between the two countries. The initiative is a part

of the government’s push towards a UPI-based payment ecosystem. In January 2023, the National Payments Corporation of India (NPCI) enabled international phone numbers to be able to transact

using UPI. The Union Cabinet had approved incentivisation schemes for promoting low-value BHIM-UPI transactions in April 2022. ALSO READ | SAFE ACROSS BORDERS: ON UNIFIED PAYMENTS

INTERFACE-PAYNOW LINK On February 21, Prime Minister Narendra Modi and his counterpart, Singapore Prime Minister Lee Hsien Loong, attended the virtual launch. The Ministry of External

Affairs said this would help the Indian diaspora in Singapore, especially migrant workers, and students, and “bring the benefits of digitalisation and fintech to the common man through the

instantaneous and low-cost transfer of money from Singapore to India and vice-versa.” HOW WILL THE SCHEME WORK? Data | India’s shift from cheques to online money transfers faster than

Singapore, US and Canada For users at the Indian end, State Bank of India, Indian Overseas Bank, Indian Bank and ICICI Bank will facilitate both inward and outward remittances, while Axis

Bank and DBS India will only facilitate inward remittances for now. DBS-Singapore and Liquid Group, a fintech company, will facilitate the service for users in Singapore. More banks will be

included in the linkage with time, the RBI said in a press release. Account holders of listed banks can transfer funds to/from India using their UPI ID, mobile number, or Virtual Payment

Address (VPA). To begin with, Indian users can remit up to ₹60,000 per day. This is equal to around $ (Singapore) 1,000. Cross-border remittances to Singapore can be done through the bank’s

mobile application or internet banking facilities. Apps of participating Indian banks will have an opt in/opt out feature for receiving remittances from Singapore. Currently, only UPI IDs

registered with the same bank where an account is held can be used to receive remittances in accounts of participating banks. The P2P remittances between India and Singapore are only allowed

for purposes of “maintenance of relatives abroad” and “gifts”. According to the RBI, participating banks will roll out updates to allow global remittances in their UPI apps in a phased

manner. India has also considered allowing UPI remittances from other countries like the United Arab Emirates (UAE) which hosts a large Indian population. In November 2022, India and UAE

discussed allowing cross-border remittances through UPI platforms during a meeting between External Affairs Minister S. Jaishankar and UAE Foreign Minister Sheikh Abdullah bin Zayed Al

Nahyan in New Delhi. NRIs from 10 countries can use UPI with their international mobile numbers WHAT ARE REAL-TIME PAYMENTS (RTP)? As the name suggests, real-time payments are money

transfers that are mostly settled as soon as they are performed. RTPs are allowed 24x7, 365 days a year. They help simplify the process of fund transfer as well as ease communication between

the payer and the payee. P2P payments involve the transfer of funds from one user’s bank account to another through a digital medium. Common examples of P2P mobile apps in India include

GPay and Paytm. Using P2P payments eliminates the risk of sharing bank account details. In 2022, UPI payments worth ₹8,31,993.11 crore were recorded in January. This figure climbed to

₹12,81,970.86 crore in December. Published - February 26, 2023 01:04 am IST Read Comments Remove SEE ALL PRINT RELATED TOPICS banking / The Hindu Explains / India / Singapore

Trending News

Drivers urged to pay car tax ahead of major ved changes next monthThe standard rate will increase by £10 for most cars which were first registered on or after April 1, 2017. For cars reg...

England scrum-half unavailable after he confirms move to new zealand for 2024 season - ruckWILLI HEINZ WILL TAKE THE FIELD FOR THE CRUSADERS IN THE 2024 SEASON, CONTINUING HIS STELLAR RETURN TO SUPER RUGBY. The...

Page Not Found很抱歉,你所访问的页面已不存在了。 如有疑问,请电邮[email protected] 你仍然可选择浏览首页或以下栏目内容 : 新闻 生活 娱乐 财经 体育 视频 播客 新报业媒体有限公司版权所有(公司登记号:202120748H)...

First baby due in new ivf technique | nursing timesThe first baby to be conceived using a breakthrough IVF technique will be born in Scotland next month, a clinic has said...

Elevation and fog-cloud similarity in tibeto-burman languagesABSTRACT Lexically, 52.99% of the Tibeto-Burman languages, the non-Sinitic branches of the Sino-Tibetan language family,...

Latests News

Explained | who will benefit from the upi-paynow link?THE STORY SO FAR: On February 21, India’s Unified Payments Interface (UPI) and Singapore’s PayNow were officially connec...

Sally rooney is wrong to boycott israel. Here’s why | thearticleSally Rooney is the most successful of the younger generation of Irish writers. Her second novel _Normal People _was ada...

Gary sinise salutes the real lt. DansMemorial Day Sale! Join AARP for just $11 per year with a 5-year membership Join now and get a FREE gift. Expires 6/4 G...

Want to improve your memory and focus? Try thisExercise isn’t just for your body — your mind can benefit from a good workout too. And research shows that learning anot...

They can menagerie just fine, thanksMozart and Charlie Chaplin ran from the guests--acceptable behavior for llamas. The pygmy goats, Fred and Ethel, were fr...